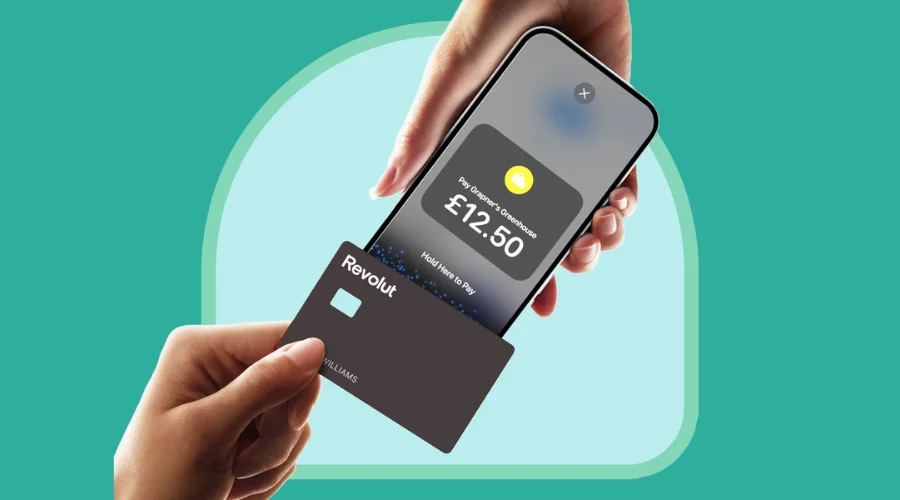

Revolut is a UK-based digital banking and financial technology company that offers a range of financial services, including online payments, foreign currency exchange, and cryptocurrency exchange. Among these services, one of the most useful and convenient features is the ability to accept card payments online.

Revolut allows businesses to accept card payments online by using a payment gateway. The payment gateway acts as an intermediary between the business and the customer’s bank, allowing the transaction to take place securely and efficiently.

How to accept card payments online on Revolut?

Revolut allows businesses to accept card payments online by using a payment gateway. The payment gateway acts as an intermediary between the business and the customer’s bank, allowing the transaction to take place securely and efficiently. To set up the payment gateway, businesses need to follow these steps:

Sign up for a Revolut business account: To use Revolut’s online payment services, businesses need to sign up for a Revolut business account. The account setup process is straightforward and can be completed within a few minutes.

Connect to the payment gateway: Once the business account is set up, businesses can connect to Revolut’s payment gateway by integrating it with their website or e-commerce platform. Revolut supports a range of payment gateway integrations, including Stripe, PayPal, and Adyen.

Start accepting card payments: After the payment gateway integration is complete, businesses can start taking card payments online. Customers can enter their payment details on the business’s website or e-commerce platform, and the payment will be processed through Revolut’s payment gateway.

Advantages of accepting card payments online on Revolut

1. Increased convenience:

Accepting card payments online is more convenient than traditional payment methods, such as cash or cheques. Customers can make payments from anywhere, at any time, using their mobile phone, tablet or computer.

2. Faster payment processing:

Online card payments are processed faster than traditional payment methods, such as cheques or bank transfers. This means that businesses can receive payments more quickly, improving cash flow and reducing the risk of late payments.

3. Improved security:

Revolut’s payment gateway uses advanced security measures to protect against fraud and ensure that transactions are secure. This gives businesses and customers peace of mind, knowing that their payment details are safe.

4. Access to global customers:

By accepting card payments online, businesses can reach a global audience and expand their customer base. Customers from all over the world can make payments using their debit or credit card, making it easier for businesses to sell their products or services internationally.

5. Lower transaction fees:

Revolut’s online payment services offer lower transaction fees compared to traditional payment methods, such as bank transfers or cheques. This can help businesses save money on transaction fees and improve their bottom line.

Types of deals offered by Revolut for businesses to accept card payments online

In today’s fast-paced and digital world, it is essential for businesses to accept card payments online. Online payments have become an integral part of the e-commerce ecosystem, and with the rise of mobile devices and internet accessibility, online payments have become even more accessible. Revolut is one of the leading online payment providers, offering several deals and services for businesses to accept card payments online.

Revolut offers several deals and services for businesses to accept card payments online. Whether it is through Revolut for Business, Revolut Payment Links, Revolut Web Payments, or Revolut Invoicing, businesses can choose the service that best suits their needs. Accepting card payments online has become a necessity for businesses, and with Revolut, businesses can do so securely and efficiently.

Revolut for Business is a service designed specifically for businesses. With this service, businesses can create a business account and start accepting card payments online. Revolut for Business offers a range of features, including a dashboard that provides insights into transactions, the ability to issue virtual and physical cards, and the ability to manage team members’ permissions. Businesses can also benefit from the ability to send and receive payments in multiple currencies, making it easier for businesses to operate globally.

Revolut Payment Links is another service offered by Revolut, which allows businesses to create custom payment links that can be shared with customers via email, social media, or messaging apps. With Revolut Payment Links, businesses can accept card payments online without the need for a website or e-commerce platform. Payment links can be customized to include payment details, product descriptions, and the ability to pay in multiple currencies. Businesses can also set up payment reminders to encourage customers to pay on time.

Revolut Web Payments is a service that allows businesses to integrate card payments directly into their website or e-commerce platform. With Revolut Web Payments, businesses can customize the checkout process and offer multiple payment options, including credit and debit cards. Revolut Web Payments also offers fraud detection and prevention tools, ensuring that businesses can accept card payments online securely.

Revolut Invoicing is a service that allows businesses to create and send invoices to customers via email. With Revolut Invoicing, businesses can customize invoices with their branding, set up recurring invoices, and accept card payments online. Invoices can also be tracked and managed in real-time, providing businesses with insights into their cash flow.

Conclusion

Accepting card payments online through Revolut is a simple and secure way for businesses to streamline their payment processes. With Revolut’s easy-to-use platform, businesses can quickly and easily set up online payments, and customers can enjoy a seamless checkout experience. For more information, visit Feedhour.